Which is a Better Investment: Real Estate or the Stock Market?

The internet has increased people's understanding of the long-term advantages of saving and investing. Even at such a young age, some people have developed impressive stock market holdings. Nonetheless, there are others who think that investing is limited to the stock market alone. Real Estate can also be discussed. Some financial experts and economists argue that Real Estate is a safer long-term investment than the Stocks Market.

5 Mortgage Tips to Help You Get the Best Deal

Potential homeowners may find the process of applying for a mortgage to be difficult and sometimes irritating, but it doesn't have to be. You can simplify the home-buying process and make sure you're getting a loan that fits your needs and budget by keeping in mind these mortgage tips.

What to Avoid During Mortgage Approval

Once you've been preapproved for a mortgage, you're well on your way to financing a home. But there are still miles to go until the finish line, and the journey might be bumpy if you're not careful.

A lender's preapproval offer is based on a review of your credit, income, debt, and assets. If those conditions change considerably before final approval, the offer may be withdrawn.

Here are some things you should not do before the loan closes:

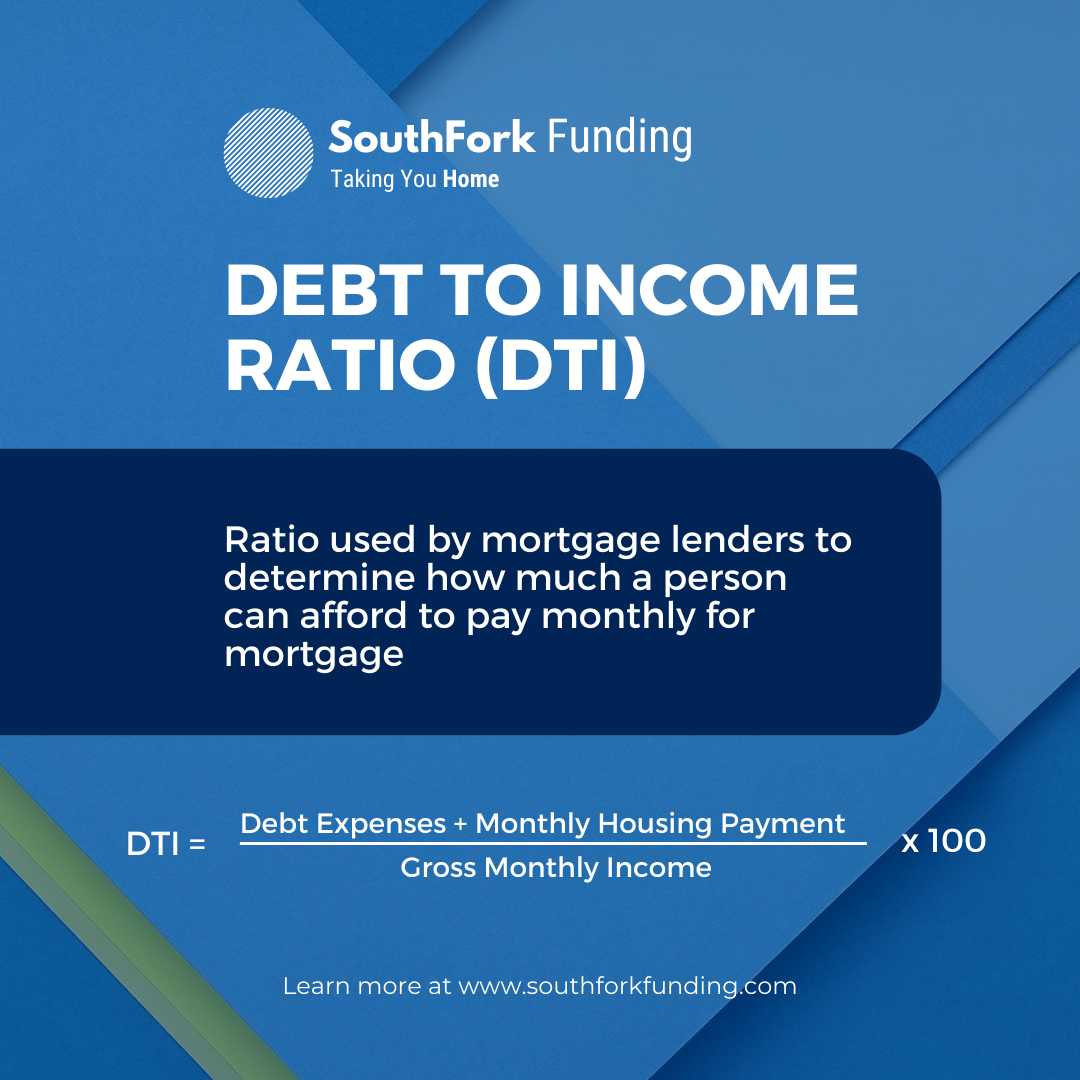

Debt-to-Income (DTI) Ratio

Lenders assess your borrowing risk using your debt-to-income (DTI) ratio, which is the proportion of your gross monthly income that is utilized to pay your debts each month

What is a Non-QM Mortgage?

What is Debt to Income Ratio? (DTI)

Lenders assess your borrowing risk using your debt-to-income (DTI) ratio, which is the proportion of your gross monthly income that is utilized to pay your debts each month.